When integrated into decision making, competitive intelligence gives a significant competitive advantage to its possessors. Price intelligence is a great source for gaining a competitive edge. However, for e-commerce owners, the number of players in the market might be intimidating. That’s why you need to automate the competitor price tracking process.

Democratization of data

Ecommerce is a digital market where accessibility and convenience are at their best.

Although it can still be achieved, loyalty is not granted to any particular e-commerce site in the world – including yours. Loyalty in ecommerce is almost crafted at every single purchasing journey. To sustain it in the long term, you must adapt to the changing motivations of your customers.

You should be extremely good at understanding these dynamics and detecting the reasons why visitors coming to your website through various paths do not eventually convert.

But it doesn’t take a scientist to know that you have to keep track of competitor strategies. Competitive intelligence gathering is of central importance to your business.

Back when the world was not entirely digitalized, competitive intelligence gathering depended on individuals conducting serious and time-consuming research to collect data. Thus, it was too expensive for small businesses.

Therefore, it had limited accessibility within the market and had been more of an enterprise activity/need/asset. However, thanks to the digitalization of all sorts of businesses, including retail, the nature of competitive intelligence has also been reshaped.

The much-desired market data has turned into digital market data, which can be virtually accessed from anywhere by using the necessary technologies.

Automation replaced manual work, which dramatically decreased the costs of accessing fresh data from competitive landscapes and analyzing it.

Why pricing intelligence is particularly important

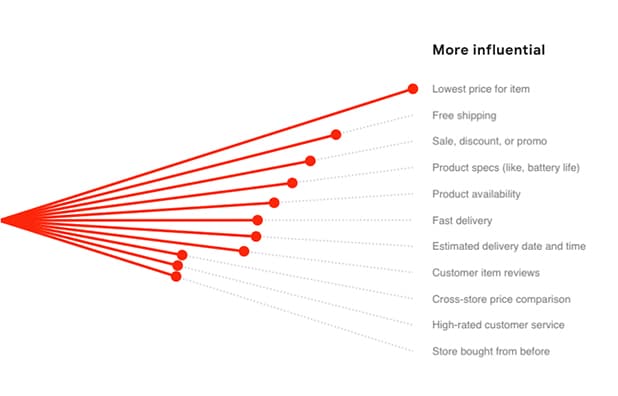

The most influential reason when the UK and US shoppers decide to buy an online item is the low prices.

Shoppers no longer need to wander from one shop to another to find the best price out there. Thanks to comparison shopping engines, they can simply browse through tons of options for a particular product and pick the one that attracts them most.

Deal-hunting is no longer a sport at all. Comparison shopping engines (CSEs) drive around %25 of the website traffic for ecommerce websites, and this ratio is even higher for e-commerce sites in more price-sensitive verticals, like consumer electronics.

With all these in mind, wouldn’t it be odd for you to simply ignore the prices of your competitors?

If the answer is yes, then you have to automate the process. Manual price tracking takes too much time. Even if you spare the time, the data you’ll be collecting won’t be relevant by the time you finish.

So, if you’re ready, let’s look at how you can automate price tracking.

Pre-automation Steps: Filling in the blanks of the competitive landscape

Effective implementation of business intelligence tools of all sorts heavily relies on prior research.

Selecting which competitors to track

The decision on which competitors to monitor should rely on data and insights provided by the category and product managers within the company. They know their category or product-specific competitors by heart.

Competitors that have been initially listed down – by the category or product managers – should be further analyzed in terms of estimated monthly traffic, growth rates, or marketing channels and should be eliminated according to a certain strategic threshold.

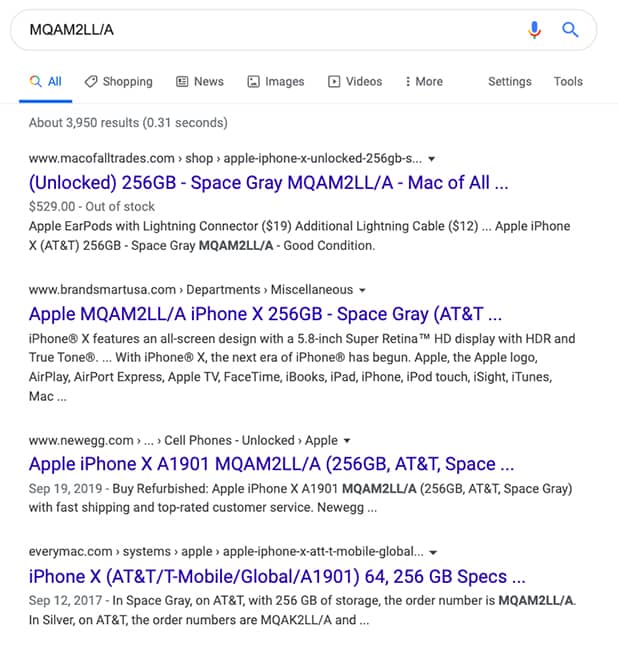

Identifying the significance of competitors can be checked by using a search engine, like Google and a website analytics tool like SimilarWeb together.

Refinement of an initially prepared list should also be extended by a ground-up approach, like simply Googleing for major SKUs in your assortment and listing down the top website results, which are your competitors.

In the end, you’ll end up with a list of competitor websites worth monitoring continuously.

Selecting which products to benchmark vs. competitors

Not all SKUs are created equal.

There are some products that perform significantly better than others within certain periods of time, or there are certain product groups that account for a large portion of a company’s revenue.

The most important factor affecting the competitiveness of a particular product is the demand for it in the market.

Online demand can be analyzed or traced in many different ways. Demand for online products can be estimated by taking a look at the internal sales data and free search data.

Use Google Keyword Planner to find out how many shoppers are searching for certain products online. Products with significantly higher search volumes in Google generate more demand.

Many verticals of the ecommerce market carry the characteristics of Pareto distribution. Therefore, it’s not surprising to see that around %20 of the overall SKUs constitute 80% of the total revenue.

As competitive intelligence requires intensive focus, leaving the products that constitute the remaining %20 of the revenue would let a company focus on just one-fifth of its whole assortment. – or, in some categories, even less.

Depending on your competitive strategy, these ratios of %80 and %20 can be fine-tuned and the refinement within the product assortment can be redesigned.

In the end, what you’ll have in hand will not be just a list of the products to be benchmarked vs. your competitors, but a dynamic approach that will yield such a list dynamically any time you need, say once in every month or quarter.

Therefore, you can actually update your competitive assortment to be benchmarked vs. your competitors, depending on your strategy.

Gathering/Importing the product links into your competitor price tracker account

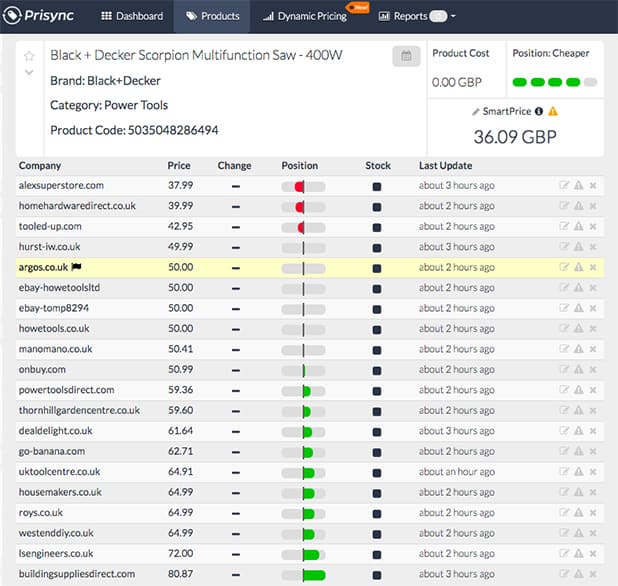

As the lists for competitors and products have been gathered, a one-time mapping of the products’ URLs is required to direct the price tracker to the relevant products’ links.

When mapping has been completed, the data containing the products to be monitored along with their links can be simply bulk imported into your dashboard.

As mentioned before, the list of the products or even the list of the competitors to be monitored may be dynamic. Therefore, in case of the appearance of a new competitor or following the launch of a new competitive product line, new batches can simply be imported into the dashboard.

After completing all these pre-automation setups, you start gaining crucial insights vs. your competitors in a fully automated way and get started with acting on these insights.

pricing strategies

Leave a Reply